SEIS / EIS

Tax Incentives

Supercharge Your Investment with SEIS/ EIS

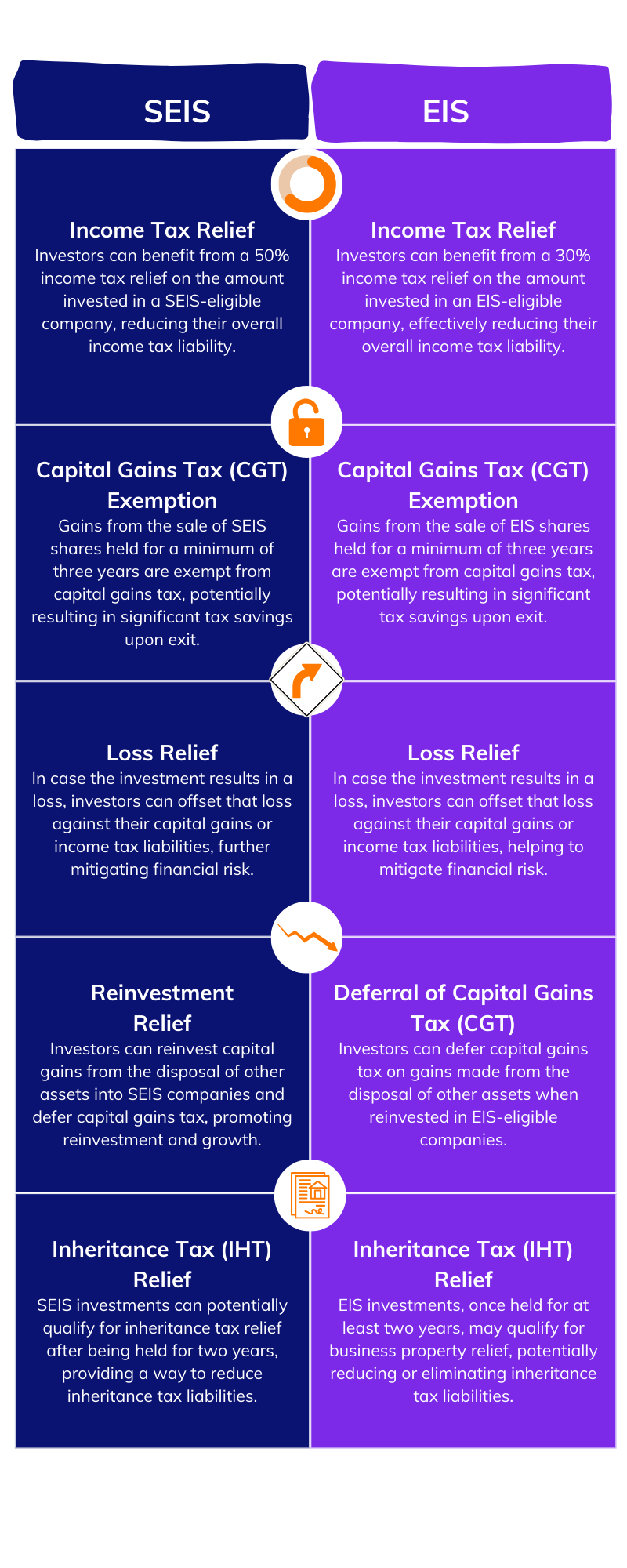

The Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) are UK government initiatives that encourage investment in early-stage and innovative companies. SEIS provides substantial tax incentives to investors, including a 50% income tax relief and capital gains tax exemption, aiming to boost funding for startups. EIS offers similar benefits, including a 30% income tax relief, capital gains tax exemption, and loss relief, encouraging investment in higher-risk small to medium-sized enterprises. These schemes promote economic growth, innovation, and entrepreneurship while mitigating investment risk through tax incentives.

How can we help?

Setting up the Seed Enterprise Investment Scheme (SEIS) or Enterprise Investment Scheme (EIS) involves several steps to ensure compliance with the scheme's requirements and eligibility criteria. Here's how we can help:

4. Submit a Compliance Statement

After issuing shares, you must submit a compliance statement (form EIS1) to HMRC for the shares issued, to allow your investors to claim EIS tax reliefs. You’ll need to provide necessary documents such as the business plan, financial forecasts, memorandum and articles of association, and other relevant information.

5. Post-Investment Compliance

If HMRC agrees with your application, they will send you a letter of authorisation, a unique reference number, and a compliance certificate (form EIS3) to give to your investors. You must maintain compliance with SEIS or EIS rules, such as the utilisation of funds for qualifying business activities and reporting requirements, to retain the benefits for both your company and investors.

Benefits of investing in SEIS vs EIS

Investors can easily claim their SEIS/ EIS tax reliefs by following specific steps. We’re here to help!

Talk to us

Schedule a free consultation to optimise tax efficiency for your Startup