RESEARCH & DEVELOPMENT (R&D)

TAX RELIEF

R&D Tax Credits Explained

Research and Development (R&D) tax relief is a government incentive designed to encourage businesses to invest in research and development activities. These activities aim to drive innovation, improve processes, and develop new products, services, or technologies that can contribute to economic growth and competitiveness.

R&D tax relief provides financial benefits to companies that engage in qualifying R&D activities. The relief comes in the form of tax deductions or credits, allowing companies to either reduce their taxable income or receive a direct cash payment.

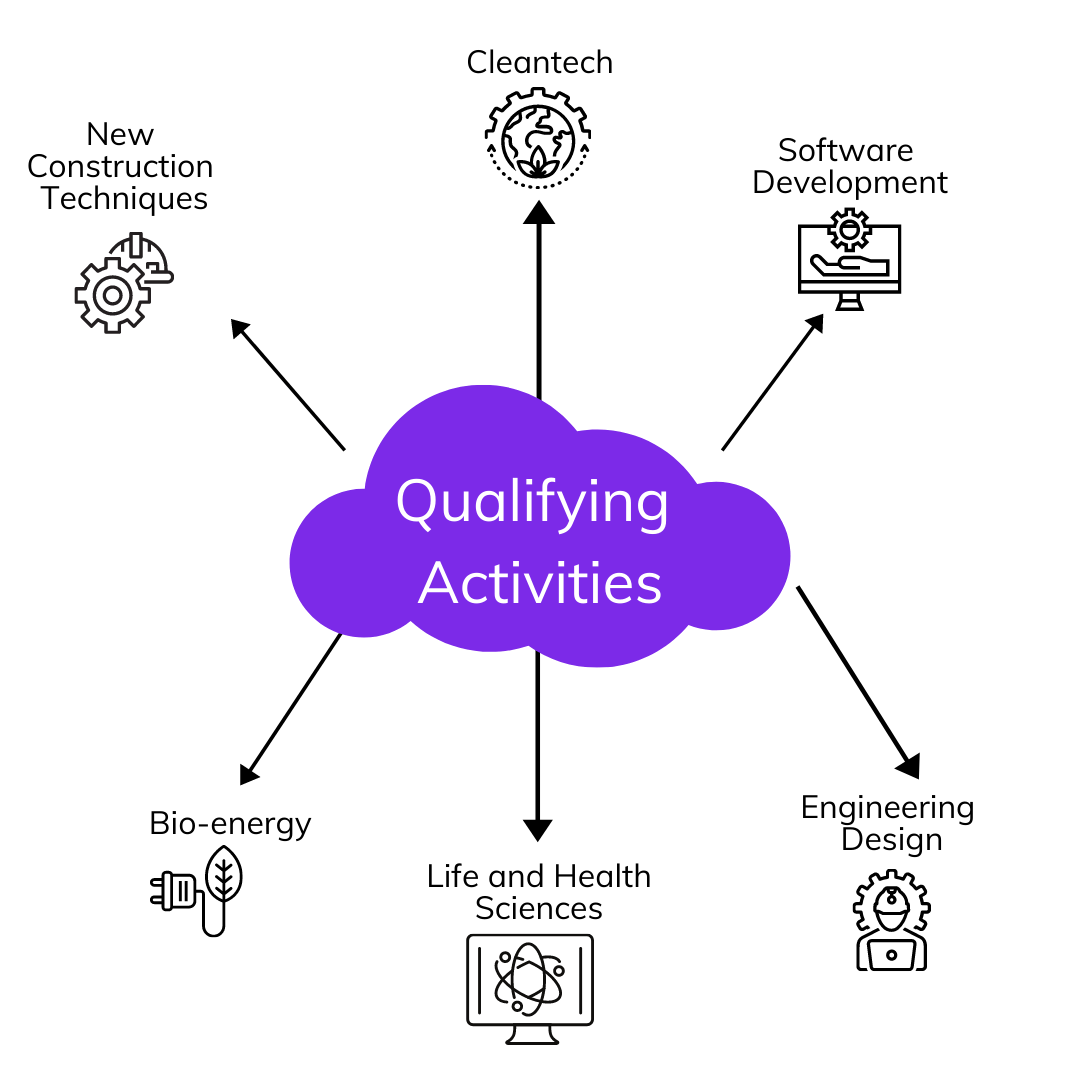

To be eligible for R&D tax relief, a company must engage in activities that qualify as research and development according to the guidelines set by HMRC. These activities typically involve technical uncertainties, where a company is trying to resolve technological challenges or uncertainties that aren't easily solvable by standard practices

Examples of research activities

- Activities with the aim of obtaining new knowledge

- Searching for alternatives for materials, devices, products, processes, systems or services

- Formulating, designing, evaluating and selecting such possible alternatives.

Our process

How we work?

Getting to know you

We understand that no two businesses are the same, so it’s vital that we really get to know you and your company. During our introduction call we will focus on your main business activities, discuss the projects to you wish to claim tax relief on and answer any queries you may have around R&D and the claim process itself.

Claim report

Once we are confident that your project qualifies for R&D, our technical advisor will arrange a phone call with you to go through the report in further detail. HMRC have strict requirements surrounding the technical report which we will need to make sure are met ahead of submission.

Submitting claim with HMRC

Once you are happy with the final reports, we will submit these to HMRC. Should HMRC have any queries following the submission of your report, we will manage these on your behalf.

Why us?